Renters Insurance in and around Clifton Park

Renters of Clifton Park, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Clifton Park

- Troy

- Albany

- Saratoga

- Latham

- Mechanicville

- Halfmoon

- Wynantskill

- Brunswick

- Waterford

- Country Knolls

- Watervliet

- Loudonville

- Cohoes

- Ballston Spa

- Rexford

- Stillwater

- Schenectady

- Milton

- Menands

- Connecticut

- Vermont

- New Jersey

- Pennsylvania

Calling All Clifton Park Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or apartment, renters insurance can be the most sensible step to protect your stuff, including your hiking shoes, tablet, bicycle, sports equipment, and more.

Renters of Clifton Park, State Farm can cover you

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Tim McGrath can help you with a plan for when the unexpected, like a fire or an accident, affects your personal belongings.

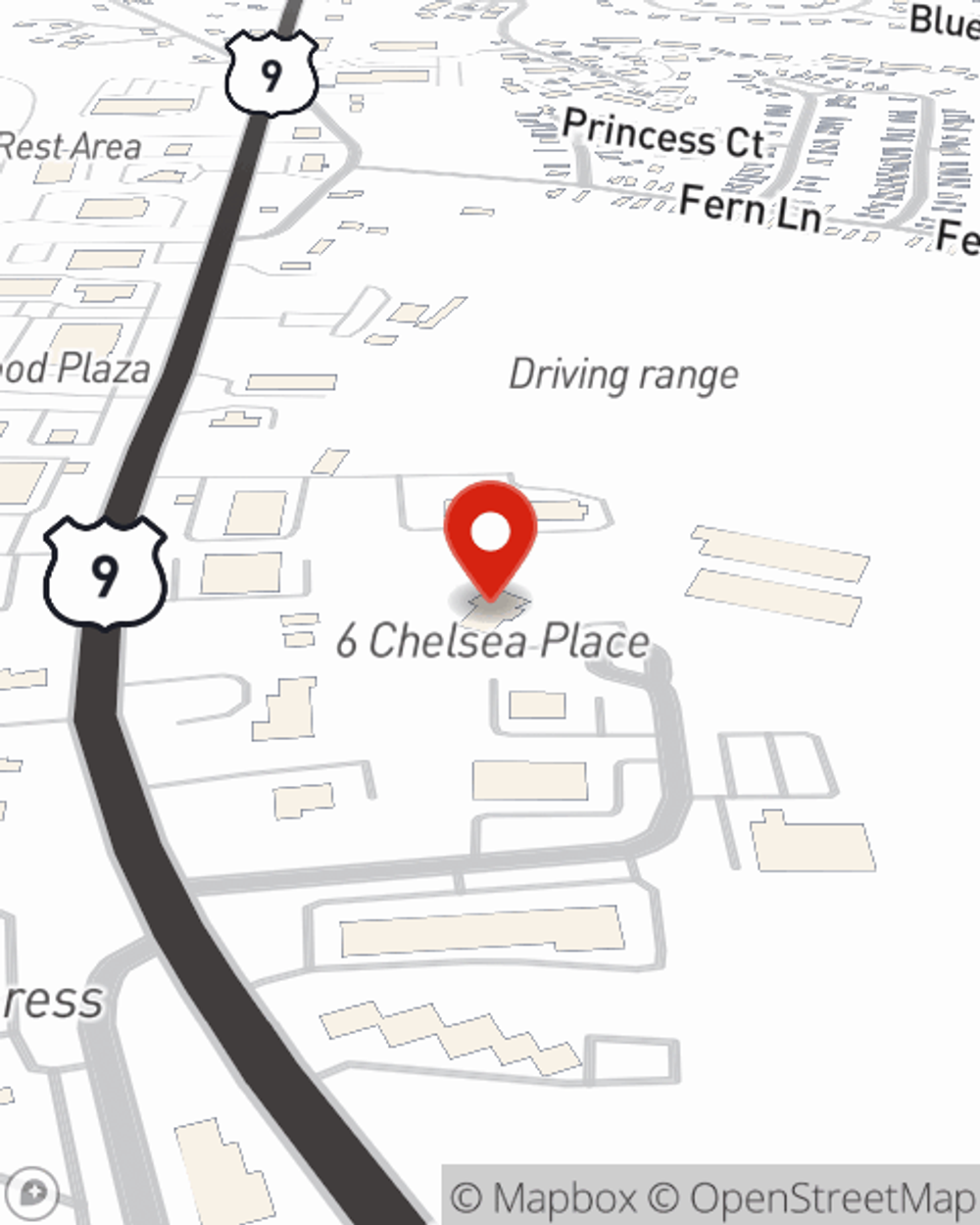

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Clifton Park. Reach out to agent Tim McGrath's office to get started on a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Tim at (518) 631-5113 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Tim McGrath

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.